Best Payroll Compliance System in Australia

Effective payroll compliance is essential to avoid costly errors and penalties. ClockOn's intuitive software automates processes, ensuring seamless adherence to regulations.

ClockOn is the leading payroll software solution that makes managing employee payments a breeze. Whether you’re a start-up or an established business, our rostering and attendance solutions are perfect for you.

Rostering offers concise labour cost controls and scheduling by individual employee or by role.

Easily monitor employee attendance with our time-recording system that can be tailored to your specific needs.

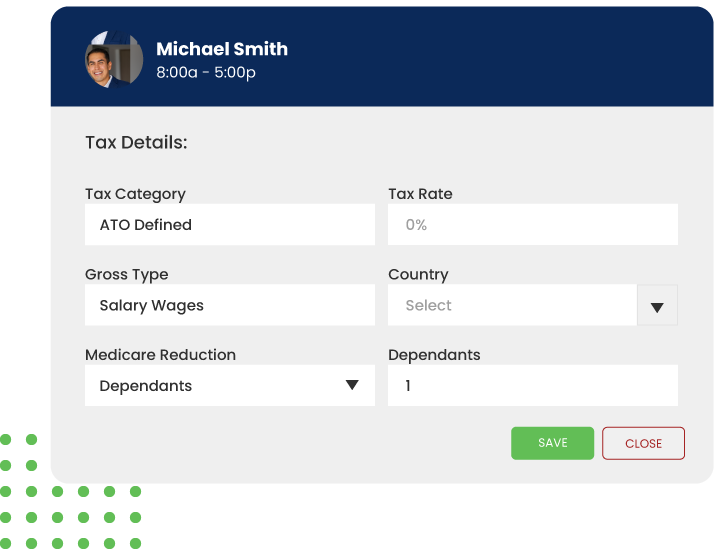

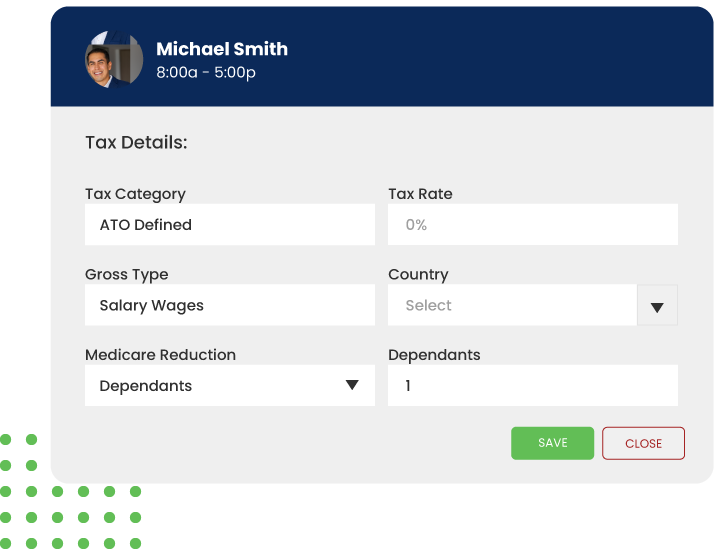

With our payroll solution, you can easily process payments, file taxes and manage employee information.

We’ve worked hard to make a system that is specifically tailored to the needs of your business. Keeping track of your business just got easier with the help of our workforce management software.

Streamline your staff scheduling process and automates the interpretation of payroll with powerful rule-engine.

All your shifts and hours in one place, displayed in one easy-to-manage interface.

Simply manage rosters and timesheets for your facility, and automate award interpretation with custom rulesets

Adaptive payroll software takes the agony out of running a fast-casual restaurant.

From processing time to reporting, optimize employee data and give managers visibility like never before.

Reduce your admin time and onboard staff quickly. Rostering, attendance and payroll all-in-one system.

Take control of your payroll expenses now! Discover the true cost of your payroll with our On-Costs Calculator. Start making informed decisions for your business today!

Effective payroll compliance is essential to avoid costly errors and penalties. ClockOn's intuitive software automates processes, ensuring seamless adherence to regulations.

Payroll compliance is critical for businesses of all sizes, ensuring that they adhere to complex and ever-changing regulations around employee compensation. In fact, Australian businesses paid over $250 million in litigation costs for unpaid wages within the past decade

As payroll regulations vary across industries, maintaining compliance can be overwhelming, leading to costly mistakes or legal issues. Automated payroll compliance software simplifies this process, helping companies stay compliant while reducing costs and risks.

Start streamlining your payroll processes today by exploring a demo of our payroll compliance software.

Reduce Human Error

Manual data entry and payroll calculations can lead to costly mistakes. Automating these processes drastically reduces human error, saving businesses both time and money. In fact, studies show that businesses lose thousands of dollars annually due to payroll-related mistakes.

Save Time and Increase Efficiency

Automation speeds up payroll processing by eliminating repetitive tasks, allowing HR and accounting teams to focus on strategic functions. Additionally, automated systems reduce the need for audits and corrections, freeing up even more time.

Real-Time Updates on Regulatory Changes

Payroll regulations change frequently. Software helps ensure that you're compliant by keeping your system updated with the latest laws and deadlines, preventing costly mistakes like miscalculations or missed tax filings.

Ensure Data Security and Confidentiality

Payroll compliance software is designed with security in mind, using encrypted data storage and secure access controls to ensure your sensitive employee and payroll data remain confidential and compliant with data protection laws.

Eliminate payroll errors and reduce compliance risks by trying our automated payroll compliance software today.

Learn more about our payroll compliance solutions

1. Advanced Automation for Complete Compliance

Our payroll compliance software goes beyond basic functions, offering advanced automation tools to handle complex tasks such as multi-state payroll, overtime calculations, and employee benefits management.

2. Customization for Industry-Specific Compliance Needs

Different industries face different payroll challenges. Our software can be customized to meet the compliance needs of sectors such as:

Pharmacy & Medical: Handles sector-specific regulations like Medicare taxation and labor laws for medical professionals.

Construction: Manages project-based work, variable pay, and prevailing wage laws.

Retail and Hospitality: Automates tip calculations, shift wages, and overtime rules.

Technology: Supports remote work management, freelancer payroll, and data confidentiality.

3. Comprehensive Reporting and Analytics

Our software provides detailed reports that can be customized for audits, future planning, and decision-making. Whether you're in HR, finance, or management, you’ll have access to the insights you need.

4. Seamless Integration with Accounting Systems

Our payroll compliance software is designed to integrate effortlessly with your existing MYOB or Xero accounting software. This integration ensures smooth data migration, reducing the risk of errors and duplication. It also streamlines payroll operations by automatically syncing financial data, making it easier to manage employee payments, benefits, and tax filings in one unified platform. By connecting seamlessly with systems like Xero, QuickBooks, or MYOB, your payroll process becomes more efficient and reliable.

Learn more about our payroll compliance software

Payroll compliance is essential to maintaining financial health and employee satisfaction. Sign up for a free trial or schedule a demo to see how our payroll compliance software can help streamline your operations and ensure total compliance.

ClockOn Payroll offers a suite of features designed to streamline payroll management for Australian businesses. Its capabilities in automation, compliance, integration, and reporting make it a comprehensive solution for tackling the diverse challenges of payroll processing.

ClockOn streamlines payroll management by automatically calculating wages, taxes, and superannuation, and seamlessly integrating with electronic timesheets for accurate and efficient processing.

ClockOn ensures compliance with Australian tax laws through regular updates of ATO tax tables and superannuation rates, simplifies end-of-year processing, and enhances utility and adaptability with its capability to integrate seamlessly with various business systems.

ClockOn integrates with popular accounting software like MYOB and Xero for seamless financial management and offers flexible data export options to ensure compatibility with a variety of business platforms.

ClockOn offers over 250 customizable payroll reports and real-time data access, enabling businesses to tailor reporting to their specific needs and facilitate quick decision-making and strategic planning.

Trusted by businesses great and small

We help businesses of all shapes and sizes but we are especially popular in the following industries

Combining robust reporting and intuitive dashboards, ClockOn is the payroll solution that adapts to the ever-changing needs of pharmacies.

Prevent employee time and identify theft with fully integrated rostering, time and attendance recording and payroll functionality across multiple store locations

Increase staff efficiency and productivity across your practice by providing better control and administration for timesheets and salaries.

Easy to use payroll software that takes the agony out of running a fast-casual restaurant. Streamline payroll, employee scheduling and much more.

Saves time and money by automating rules, settings, and additional tasks related to processing data. Reports are automatically generated, saving you time and money.

Manage, schedule and assign available shifts via the mobile app. Manage your store staff on the go, with the best scheduling tool for retail.

Peak hour, overtime, absentees, and leave requests. ClockOn’s full functionality makes it easy for you to balance your rosters and manage your payroll.

ClockOn is a simple and user-friendly tool that helps you take control of your rosters. Setting up rosters is fast and easy, with the option to customise roster templates for individual time off requests.

ClockOn is rostering, attendance, and payroll software all in one. It’s the smart way to manage your employees’ shift patterns, timesheets, and payroll.

© Copyright 2023 ClockOn Pty Ltd. | All Rights Reserved.